Like urban areas in the United States, rural areas currently face a housing affordability crisis.

Approximately 6.9 million (27%) of rural or small-town households are considered “cost-burdened” (paying more than 30% of their monthly income on housing costs).

But one of the more effective tools for ensuring affordable housing in rural areas over the past several decades, the U.S. Department of Agriculture’s Section 515 program, is reaching a turning point that could dramatically reduce the number of affordable housing units available in those areas.

New research led by Humphrey School of Public Affairs Professor and Associate Dean Ryan Allen examines the impact of the Section 515 program in the Midwest and recommends policy changes to ensure it remains viable in future years. The research was a collaboration among the University of Minnesota’s Center for Urban and Regional Affairs (CURA), the Minnesota Housing Partnership (MHP), and the Housing Justice Center.

Section 515 explained

The Section 515 program, established in 1949, provides low-interest loans to property owners to build or purchase multifamily rental housing, and restricts the amount of rent that can be charged to the tenants. Section 515 rental housing is frequently coupled with Section 521 Rental Assistance, ensuring these homes are affordable to rural residents with extremely low incomes.

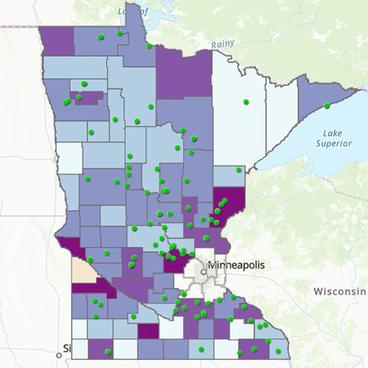

In 2020, Section 515 properties accounted for almost 19% of the nearly 50,000 subsidized housing units in greater Minnesota.

Section 515 properties are required to maintain affordability restrictions for the life of the loan (50 years). But once the mortgages are paid off, owners have the option to convert their properties to other uses, including market-rate housing. In Minnesota, the peak of mortgage maturations will occur in 2030.

As more and more Section 515 properties mature out of the program over the next 10 to 30 years, the Midwest stands to lose thousands of affordable rural rental homes.

With no clear contingency plan for maintaining the affordability of these properties, Allen said an already difficult situation will become worse.

"The scarcity of affordable housing is reaching a crisis point in rural areas,” said Allen. “In some rural communities, Section 515 housing is the only supply of subsidized housing. Ensuring the continued vitality of rural communities will likely mean creating a plan for how to keep these housing units affordable."

Section 515 housing in the Midwest

The report includes background on the Section 515 program, insights from Section 515 stakeholders, and recommendations for policymakers to ensure the program remains viable in future years.

It concludes that the Midwest will see a large proportion of its Section 515 properties mature out of the program earlier than the U.S. overall. The peak of mortgage maturations for Section 515 properties in the Midwest will occur in 2030, about 10 years before the peak for the U.S. as a whole. In Minnesota, it estimates that 2,125 Section 515 units will mature and potentially leave the program by 2030.

Section 515 properties in the Midwest have unique characteristics that may contribute to the turnover:

- The average Section 515 property in the Midwest is smaller than the U.S. average. As a result, owners may have a harder time absorbing related costs compared to owners of larger properties – costs for items like capital maintenance and complex real estate transactions.

- Nearly 40% of Midwest Section 515 properties are owned by nonprofit organizations, about double the proportion in the country as a whole. Nonprofits in rural areas are often small and less able to manage large amounts of financial risk or complicated tasks associated with raising capital and navigating government programs.

- Midwest Section 515 properties are more likely to be used by seniors than in other states. Thus, some of rural Minnesota’s most vulnerable households are at risk of substantial rent increases and potential dislocation.

Changes in the housing market in many rural counties and in the Section 515 program itself have made it less attractive to private owners and investors. On the other hand, mission-driven owners have maintained a strong interest in the 515 program as one of the few affordable housing resources available to rural communities.

This is a solvable problem, the researchers conclude, and they propose a series of policy changes.

Recommendations

- Create unique funding support for small-scale Section 515 properties, including support for needed capital maintenance.

- Streamline the property transfer process from owners who want to exit the program to buyers willing to maintain long-term affordability, by making it easier, faster, and less risky for preservation buyers to acquire Section 515 properties, especially for small-sized properties.

- Prioritize preservation of properties based on locations in hot and cold housing markets and those with looming mortgage maturations.

“From MHP's community development work in rural communities, we know many rural residents need deeply affordable rental housing, and Section 515 rental housing is often the only affordable option in many communities,” said Jill Henricksen, MHP’s community development manager. “Preserving these properties is critical both for their rental assistance and to update these aging properties, before it is too late."